Introduction

The stock market operates within specific trading hours, typically from 9:30 AM to 4:00 PM EST, but that doesn’t mean the action stops when the bell rings. Roku stock after hours is an essential concept for traders and investors who follow the company’s performance closely. After-hours trading can provide valuable insights into the stock’s future movements, as it is influenced by earnings reports, announcements, and investor sentiment. In this blog post, we’ll take a detailed look at Roku’s stock performance after regular trading hours, why it matters, and how to interpret after-hours trends.

What is After-Hours Trading and Why is It Important?

Before diving into Roku stock after hours, it’s important to understand the concept of after-hours trading. This refers to the buying and selling of stocks outside regular trading hours. It typically occurs from 4:00 PM to 8:00 PM EST. Although the volume of trading is usually lower, after-hours movements can be significant, especially when major companies like Roku release earnings reports or press releases. The lack of liquidity during after-hours trading can cause more volatile price movements, which investors should monitor carefully for clues about the stock’s direction.

Factors Affecting Roku Stock After Hours

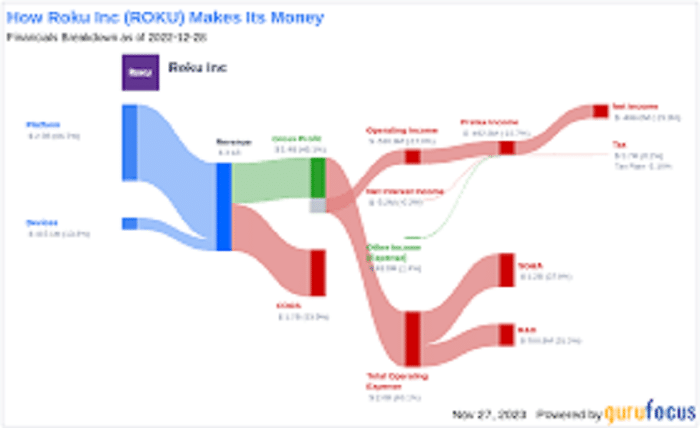

Several factors influence roku stock ranging from earnings reports and corporate announcements to broader market trends and geopolitical events. Roku, as a prominent streaming service platform, is particularly sensitive to changes in subscriber growth, advertising revenue, and competition. After-hours price movements can be a reflection of how investors react to these elements. For instance, if Roku announces a better-than-expected quarter in after-hours trading, you might see a surge in its stock price. Conversely, if its earnings fall short of expectations, the stock could dip.

The Role of Earnings Reports in Roku Stock After Hours

Earnings reports are one of the most significant catalysts for Roku stock after hours. When Roku releases its quarterly earnings report after the market closes, investors often react quickly. Positive earnings or forward guidance typically leads to stock price increases, while disappointing results can cause the stock to fall. These reports often provide insight into key metrics, such as user growth, advertising revenue, and profitability, which heavily influence investor sentiment and stock performance. Watching these reports closely is essential for understanding Roku’s stock movements in after-hours trading.

How Market Sentiment Impacts Roku Stock After Hours

Market sentiment plays a critical role in Roku stock after hours. If the broader market sentiment is positive, even mediocre earnings reports from Roku might see favorable reactions. Conversely, if the market is bearish, even strong earnings reports could result in a muted or negative response. For example, during times of economic uncertainty or market volatility, Roku’s stock may react more sensitively to external factors like inflation concerns or interest rate hikes. Investors should stay attuned to general market conditions when analyzing after-hours movements.

Key Metrics to Watch for Roku Stock After Hours

When tracking Roku stock after hours, it’s crucial to focus on key metrics that can help investors make informed decisions. Some important metrics to consider include:

- Subscriber Growth: Roku’s ability to increase its user base is a major driver of long-term value. A surge in active accounts could push the stock up after hours.

- Advertising Revenue: As advertising makes up a significant portion of Roku’s revenue, any changes or growth in ad sales will likely influence after-hours performance.

- Earnings Per Share (EPS): EPS is a critical metric for gauging profitability, and better-than-expected EPS can lead to positive after-hours stock movements.

By watching these metrics, investors can gain a clearer understanding of the factors affecting Roku’s after-hours performance.

Read more about : however synonym

Volatility and Risk in Roku Stock After Hours

Investing in Roku stock after hours carries inherent risks due to lower liquidity and higher volatility. After-hours trading generally has less volume than during regular hours, which can lead to sharp price swings. This makes it more difficult to predict price movements accurately and can result in exaggerated reactions to news or announcements. While after-hours trading provides opportunities for quick gains, it can also expose investors to greater risk. Therefore, investors should be cautious when trading Roku stock outside regular trading hours, especially if the market is reacting to unexpected news.

How to Trade Roku Stock After Hours

Trading Roku stock after hours can be done through most brokerage platforms that offer extended-hours trading. However, before diving into after-hours trading, investors should be aware of a few key differences:

- Lower Liquidity: The lower number of buyers and sellers can lead to higher price volatility.

- Wider Spreads: After hours, the bid-ask spread tends to widen, which may make it more expensive to enter or exit trades.

- Limited Orders: Some brokerage platforms might restrict certain types of orders (like stop-loss or stop-limit orders) during after-hours.

For those willing to take on the risks, after-hours trading offers the potential to capitalize on significant news or earnings reports related to Roku.

Tracking Roku Stock After Hours: Tools and Resources

To monitor Roku stock after hours, investors can use various tools and resources available on most financial websites and platforms. Websites like Yahoo Finance, Google Finance, and Bloomberg provide real-time updates on after-hours trading. Many brokerage platforms also offer after-hours data for users who trade outside regular market hours. Additionally, investors can sign up for alerts from financial news services or use stock monitoring apps that track price movements, news, and earnings releases for companies like Roku.

The Impact of Roku Stock After Hours on Long-Term Investment Strategies

For long-term investors, Roku stock after hours trading may provide valuable insights into how the market is reacting to significant news. However, day-to-day fluctuations in after-hours trading should not heavily influence long-term investment decisions. Long-term investors should focus on the overall growth trajectory of Roku, including factors like market expansion, competitive positioning, and financial health, rather than short-term price changes in after-hours trading. Still, keeping an eye on these fluctuations can help identify potential buying or selling opportunities.

Risks and Rewards of Watching Roku Stock After Hours

While Roku stock after hours can offer opportunities for quick gains, there are also considerable risks involved. Since after-hours trading is often more volatile and has less liquidity, it can be challenging to make accurate predictions. For those who rely on after-hours trading to guide investment decisions, it’s crucial to understand the broader implications of stock price movements and news releases. The rewards, however, are evident for those who can react swiftly to significant information, such as an unexpected earnings beat or a positive company announcement.

Conclusion

In conclusion, Roku stock after hours trading can provide valuable insights into the company’s performance, but it’s essential to approach it with caution. After-hours price movements are often influenced by earnings reports, investor sentiment, and broader market conditions, making it a useful tool for short-term traders and investors. However, due to the increased volatility and lower liquidity, it’s essential to be aware of the risks involved. For long-term investors, after-hours movements should not dictate investment decisions, but they can offer opportunities for timely adjustments. As always, thorough research and a clear strategy are key to navigating Roku stock after hours effectively.

FAQs

1. What is after-hours trading for Roku stock?

After-hours trading for Roku stock refers to the buying and selling of Roku shares outside of regular trading hours (4:00 PM to 8:00 PM EST). This period can offer insights into investor reactions to news, earnings reports, and other market developments.

2. Why does Roku stock move after hours?

Roku stock after hours can move significantly due to factors like earnings reports, corporate announcements, and market sentiment. Lower liquidity and volatility also contribute to price swings during this time.

3. How can I trade Roku stock after hours?

To trade Roku stock after hours, you need to use a brokerage platform that offers extended-hours trading. However, be aware of potential risks like wider bid-ask spreads and lower liquidity.

4. Can after-hours trading impact long-term Roku investments?

While Roku stock after hours can provide short-term trading opportunities, long-term investors should focus on the company’s fundamentals, such as user growth, revenue generation, and overall market positioning.

5. Is it safe to trade Roku stock after hours?

After-hours trading involves more volatility and risk due to lower trading volumes. It’s important to understand the risks involved and be cautious if you decide to trade Roku stock after hours.