My Watchlist Stocks: The Ultimate Guide to Tracking and Growing Your Portfolio

If you’re serious about investing, then “My Watchlist Stocks” is an essential tool for monitoring market movements and making informed decisions. A well-curated watchlist allows you to keep a close eye on potential investment opportunities, track the performance of existing stocks, and make timely moves when market conditions are favorable. Whether you’re just starting or have been in the game for years, mastering My Watchlist Stocks will enhance your ability to grow your portfolio. In this comprehensive guide, we’ll dive deep into how to create and manage your stock watchlist effectively, covering everything from stock selection to leveraging the best tools for tracking.

What Are “My Watchlist Stocks”?

Before diving into strategies, let’s start with the basics: what exactly are My Watchlist Stocks? In the simplest terms, a stock watchlist is a curated collection of stocks that an investor wants to monitor closely. These stocks can include ones you’re considering for future investment, companies you already own, or stocks from specific sectors you believe hold long-term potential. My Watchlist Stocks act as your personalized dashboard, helping you stay on top of market trends, price movements, and any relevant news or events that may affect your investment decisions.

Why You Need a Stock Watchlist

There are several compelling reasons why every investor should maintain My Watchlist Stocks. First, it enables you to focus on a select group of stocks rather than getting overwhelmed by the sheer number of options in the market. This concentrated approach helps you understand the companies on your list better, follow their news, and react to price changes more effectively. My Watchlist Stocks also allow for strategic planning, as you can set alerts for specific price targets or fundamental changes, ensuring you’re always ready to act when conditions align with your investment goals.

How to Choose Stocks for “My Watchlist Stocks”

When building My Watchlist Stocks, selecting the right stocks is crucial. Start by identifying your investment goals—are you looking for growth stocks, dividend-paying companies, or value plays? Next, research industries or sectors that interest you or have strong future potential. Consider metrics like price-to-earnings ratios (P/E), earnings growth, and market capitalization when evaluating stocks. It’s important to diversify My Watchlist Stocks to include companies from different sectors and varying market caps to reduce risk and take advantage of multiple growth opportunities.

Using Financial Metrics to Track “My Watchlist Stocks”

A key part of managing my watchlist is tracking important financial metrics. Keep a close eye on fundamental indicators such as revenue growth, earnings per share (EPS), return on equity (ROE), and debt-to-equity ratios. These metrics offer insight into a company’s financial health and can help you gauge whether a stock is a good long-term investment. Comparing these metrics across companies on My Watchlist Stocks helps you prioritize which ones are worth buying, holding, or selling based on performance.

Leveraging Stock Screeners to Build “My Watchlist Stocks”

Creating a powerful My Watchlist Stocks can be made easier with stock screeners—tools that filter stocks based on criteria you set, such as price, market cap, or P/E ratio. Using a stock screener allows you to quickly identify companies that match your investment strategy. Whether you’re looking for undervalued stocks or high-growth potential, stock screeners can help you populate My Watchlist Stocks with precision. Platforms like Yahoo Finance, Finviz, and TradingView provide excellent stock screening tools that can aid in this process.

Staying Informed with News and Events

For My Watchlist Stocks, keeping up with news and events related to the companies on your list is essential. Earnings reports, mergers, product launches, and even macroeconomic events can significantly impact a stock’s price. Subscribing to news alerts or using apps that send notifications for your My Watchlist Stocks ensures you’re always in the loop. Being informed about changes in company management, regulatory shifts, or industry trends can help you make timely decisions, whether it’s entering or exiting a position.

Technical Analysis for Monitoring “My Watchlist Stocks”

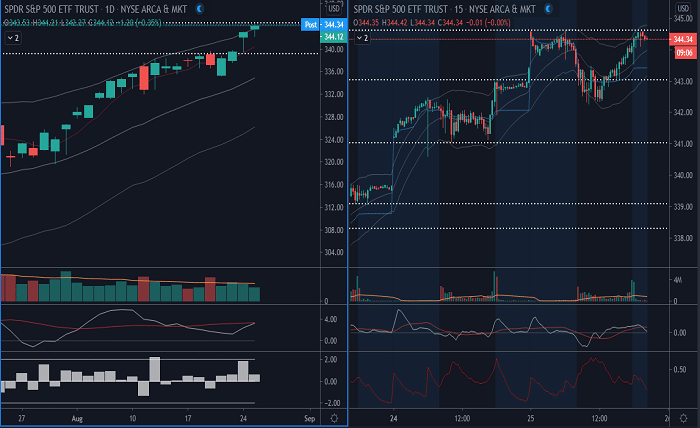

While fundamental analysis looks at the financial health of a company, technical analysis focuses on stock price patterns and market trends. When tracking My Watchlist Stocks, using tools like moving averages, relative strength index (RSI), and support/resistance levels can help you understand short-term movements and potential entry or exit points. Many investors incorporate both technical and fundamental analysis to get a fuller picture of the stock’s potential. Platforms like TradingView offer excellent charting tools that can help you monitor My Watchlist Stocks more effectively.

Utilizing Alerts for “My Watchlist Stocks”

Setting up alerts for My Watchlist Stocks is one of the most efficient ways to stay on top of market changes. Many trading platforms and apps allow you to create custom alerts based on price targets, volume changes, or news events. For example, you can set an alert for when a stock on My Watchlist Stocks drops below a certain price, indicating a potential buying opportunity. Similarly, alerts can notify you when a stock hits your target price, helping you lock in profits or review your investment strategy.

Balancing Risk with “My Watchlist Stocks”

Balancing risk is a critical aspect of managing My Watchlist Stocks. One way to reduce risk is by diversifying your watchlist across various sectors and asset classes, such as including a mix of growth stocks, dividend-paying stocks, and defensive stocks. Additionally, keep an eye on the beta of the stocks on your list—a measure of a stock’s volatility relative to the overall market. Stocks with high beta can offer high returns but also come with more risk, so maintaining a balanced My Watchlist Stocks ensures you’re not overly exposed to market swings.

Regularly Reviewing and Updating “My Watchlist Stocks”

An effective My Watchlist Stocks requires regular maintenance. The stock market is constantly changing, and so should your watchlist. Periodically review the stocks on your list to ensure they still align with your investment goals. Remove underperforming stocks or those that no longer meet your criteria, and add new opportunities as they arise. Regularly updating My Watchlist Stocks keeps your investment strategy fresh and responsive to market trends, ultimately helping you make more informed and profitable decisions.

Conclusion

Maintaining and effectively managing My Watchlist Stocks is key to a successful investment strategy. By carefully selecting stocks, utilizing financial metrics, staying informed about news and events, and balancing risk, you can ensure that your watchlist is a valuable tool for growing your portfolio. The regular review of your watchlist and the use of stock screeners, alerts, and technical analysis help you stay proactive and ready to seize opportunities. Whether you’re tracking growth stocks, value plays, or dividend earners, My Watchlist Stocks provides a streamlined and organized approach to achieving your financial goals.

FAQs

1. What is the purpose of My Watchlist Stocks?

My Watchlist Stocks allows investors to track specific stocks they are interested in, making it easier to monitor price changes, news, and market trends. It’s a useful tool for staying organized and making informed investment decisions.

2. How do I choose stocks for My Watchlist Stocks?

When selecting stocks for My Watchlist Stocks, consider your investment goals (growth, value, dividends), research industries that interest you, and evaluate financial metrics such as earnings growth and P/E ratios to ensure you’re choosing strong performers.

3. How often should I update My Watchlist Stocks?

It’s a good practice to review and update My Watchlist Stocks regularly, especially when market conditions change or new investment opportunities arise. Reviewing quarterly or after significant market events helps ensure your watchlist remains relevant.

4. What tools can I use to track My Watchlist Stocks?

You can use various tools such as Yahoo Finance, TradingView, and Google Finance to track My Watchlist Stocks. These platforms offer stock screeners, alerts, and charting features to help you monitor performance and make informed decisions.

5. How can I manage risk with My Watchlist Stocks?

To manage risk in My Watchlist Stocks, diversify across sectors and asset types, use financial metrics to evaluate stock stability, and monitor beta to understand volatility. A balanced watchlist reduces exposure to extreme market fluctuations.